On Tuesday 9th of May 2017 the European Parliament’s inquiry committee investigating the Panama papers celebrated a public hearing with representatives from Madeira, Gibraltar and the Channel Islands in order to learn more about their tax regimes. The debate was mainly focused on the extent of cooperation with the EU and on steps local authorities are taking to prevent tax scheming. It is in this context that the term “privileged tax regime” was chosen as this week’s IATE Term of the Week.

IATE defines privileged tax regime as “the tax system of any country which is substantially less burdensome than that of the country or countries with which it is being compared“. The Glossary of Tax Terms from the Organisation for Economic Co-operation and Development (OECD) goes beyond this definition and features the term privileged tax regime as an “[e]uphemism for the tax regime of a tax haven”. In any case, this term refers to a lower taxation regime applied to a specific area with the aim of stimulating business at a local or regional level.

The PANA Inquiry Committee, whose aim is to investigate alleged contraventions and maladministration in the application of Union law in relation to money laundering, tax avoidance and tax evasion, celebrated a public hearing last Tuesday on the “Cooperation in tax matters with European jurisdictions”. During this hearing, Members of the PANA Committee discussed with representatives of the Channel Islands, Gibraltar and Madeira about their tax regimes. The purpose of this hearing was to better understand the tax regimes in the respective countries and to clarify what are their relationships with the European Union. Furthermore, the PANA Inquiry Committee also took the occasion to address what is the current cooperation between the EU and the participating jurisdictions and in which ways such cooperation can be enhanced and improved. You can access the agenda, together with the multilingual video-recording of the hearing and the later press release for more information on this matter.

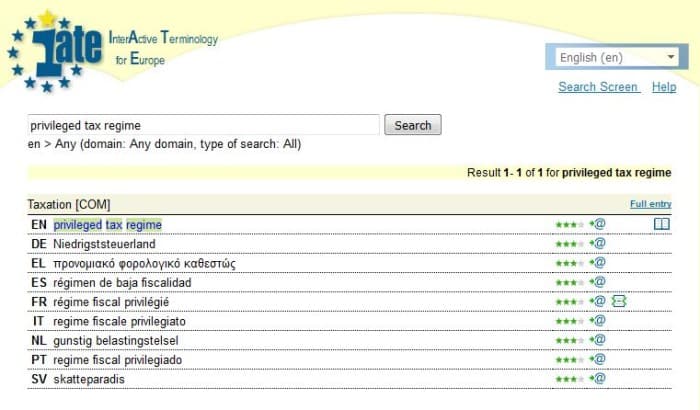

Here is a screenshot of the entry in IATE for privileged tax regime:

[su_note note_color=”#dcea0f”][su_button url=”https://docs.google.com/forms/d/1g4wuWlkEQqLLeetyKd3NJ-QSE8kn6mvUkwFpVm81rXQ/edit#” style=”flat”]Contribute to IATE![/su_button] We would appreciate your contribution to update this term in your language. An IATE terminologist of the relevant language will be in charge of the validation of contributions and, thus, a delay is to be expected.[/su_note]

However, the public hearing held this week is not the only action that the EP is taking in this context. There are many initiatives aimed at combating money laundering, tax avoidance and tax evasion that are currently being subject to debate, like the proposal to create a blacklist of states at risk of money laundering or the recent report requested by the PANA Inquiry Committee on The Impact of Schemes revealed by the Panama Papers on the Economy and Finances of a Sample of Member States.

You might also be interested in reading the following previous posts on related topics:

Term Folders

We also encourage you to check tax-related glossaries through our Glossary Links tool and through our recently-updated EU Glossaries‘ list!

Written by Doris Fernandes del Pozo – Journalist, Translator-Interpreter and Communication Trainee at the Terminology Coordination Unit of the European Parliament. She is pursuing a PhD as part of the Communication and Contemporary Information Programme of the University of Santiago de Compostela (Spain)

Sources:

- IATE (1996) Privileged tax regime. Available at: http://iate.europa.eu (Accessed 12 May 2017)

- Blomeyer and Sanz (2017) The Impact of Schemes revealed by the Panama Papers on the Economy and Finances of a Sample of Member States. Available at: http://bit.ly/2r8NpgV (Accessed 12 May 2017)

- European Parliament News (2017) Committees again reject blacklist of states at risk of money laundering. Available at: http://bit.ly/2pF2PY5 (Accessed 12 May 2017)

- European Parliament News (2017) In Parliament this week: EU citizens in the UK, tax regimes, plenary preparations. Available at: http://bit.ly/2prEeec (Accessed 12 May 2017)

- Kofod, Jeppe and JežekWorking, Petr (rapporteurs) (2016) Working Document on the inquiry into Money Laundering, Tax Avoidance and Tax Evasion. Available at: http://bit.ly/2qzkiGq (Accessed 12 May 2017)

- OCDE (n.d.) “Privileged tax regime”, Glossary of Tax Terms. Available at: http://bit.ly/2r8Nd0Q (Accessed 12 May 2017)