Every few years a similar-sounding scandal hits the global news. Whether the headline reads ‘panama papers’, ‘paradise papers’ or ‘pandora papers’, you know a big data leak is about to bring millionaires, billionaires and celebrities into trouble.

These big data leaks primarily revolve around shell entities, also known as shell companies or corporations. These kinds of companies receive their shell adjective from the fact that they form a shielding layer for other companies. They exist only as part of a complicated structure that allows companies and individuals to avoid taxes and retain financial secrecy.

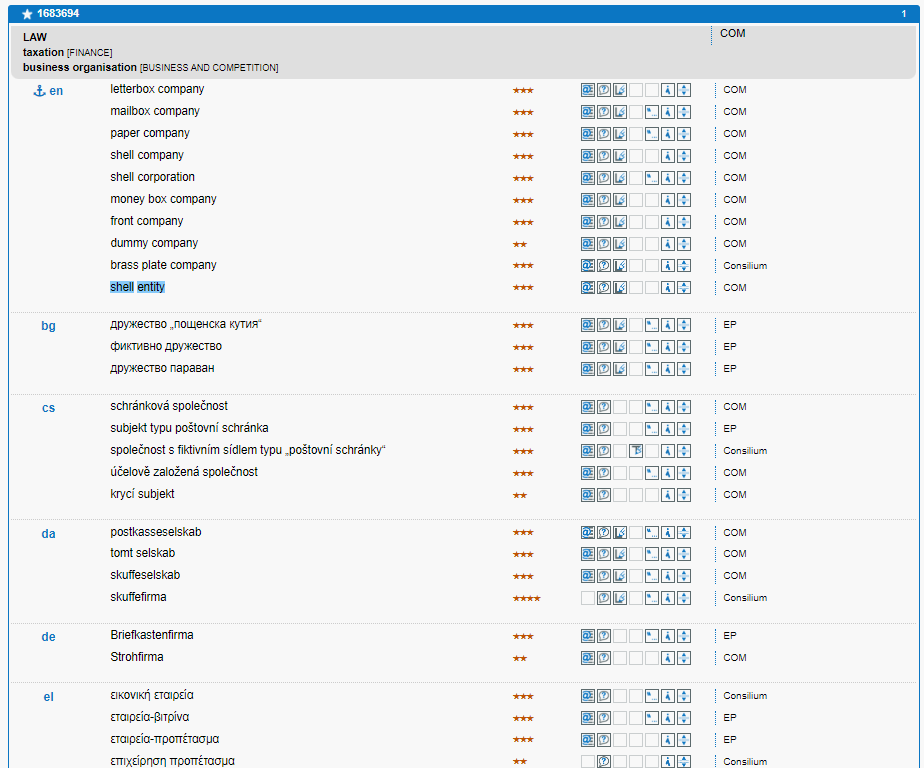

In reality the shell entities only exist on paper and do not engage in day-to-day business. They do not have employees or an office, but they do have a bank account and a registered address. This is why in many languages, these entities are known as letterbox companies: postkasseselskab (Danish), brievenbusfirma (Dutch), briefkastenfirma (German), société boîte aux lettres (French), postafiókcég (Hungarian), empresa de apartado postal (Portuguese), brevlådeföretag (Swedish) and so on.

Because shell entities only make use of an address and not the actual building, an unlimited number of companies can be registered at the same address. For example, on the Cayman Islands there is the infamous Ugland House, that counts five floors and 18,000 registered companies.

It is important to note that shell entities in itself are not illegal. Technically, tax avoidance is legal, while tax evasion is not. However, through complicated tax schemes and high levels of anonymity, the distinction between tax avoidance and tax evasion becomes very blurry. Actors with malicious intentions benefit from these circumstances, which is why money laundering, corruption, bribery and other criminal activities are often linked to shell entities.

Some European countries are also considered to be tax havens with shell entities. In 2020, the European Commission identified Belgium, Cyprus, Ireland, Luxembourg, Malta and the Netherlands as countries that have intentionally implemented laws that encourage tax schemes with shell entities. To combat these schemes, the European Parliament, Commission and Council are working on a directive together. By means of transparency standards this directive aims to prevent the misuse of shell entities for tax purposes. On the 17th of January, the Parliament will vote on the latest draft of the directive. Once adopted by the Member States, the directive should come into effect on 1 January 2024.

References:

EU member States lose EUR 170 billion per year due to EU tax havens (2022) Polish Economic Institute. Available at: https://pie.net.pl/en/eu-member-states-lose-eur-170-billion-per-year-due-to-eu-tax-havens/.

Janda, M. (2021) From money launderers to shy celebrities: Why and how people set up offshore accounts, ABC News. ABC News. Available at: https://www.abc.net.au/news/2021-10-05/offshore-companies-trusts-tax-and-secrecy-explained/100514250.

Pacini, C., Hopwood, W., Young, G. & Crain, J. 2019, “The role of shell entities in fraud and other financial crimes”, Managerial Auditing Journal, vol. 34, no. 3, pp. 247-267.

Press corner. European Commission – European Commission. Available at: https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_6968.

Scholtes, S. & Houlder, V. (2004, 9 mei). Ugland House, home to 18,857. Financial Times. Accessed 5 January 2023, from https://www.ft.com/content/9a9b84fa-38e6-11de-8cfe-00144feabdc0

Written by: Kamiel Vermeulen