The financial crisis of 2008, also called Global Financial Crisis, affected the whole world and its repercussions are still visible today. This event was the worst economic collapse since the Great Depression at the end of the 1920s.

The consequences were devastating: famous banks had to bail out and the unemployment rate was at its highest. In the European Union, the banking systems of Greece, Spain, Italy, Portugal and Ireland collapsed. Those events led to a loss of confidence in the EU economy and businesses. In this sense, we can say that this crisis helped us understand how much co-dependent the banking systems of the different members of the European Union were. It means that, in case of severe problem, all of the economic systems of the European Union could collapse because of the domino effect.

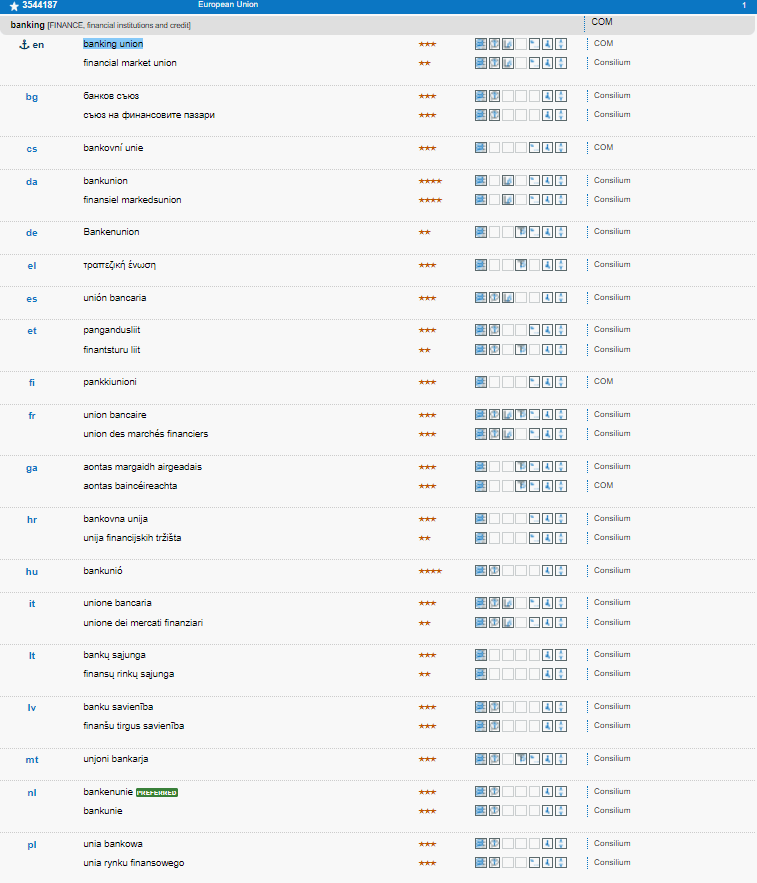

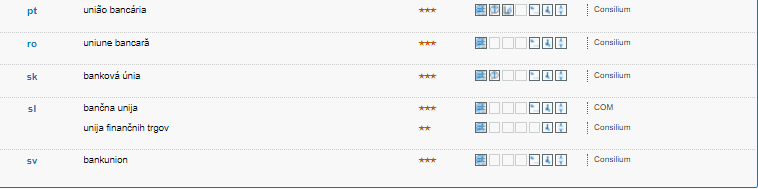

The Banking Union was born as result to this observation. This initiative was built up to prevent this kind of escalation in the future, in case of a massive financial crisis.

Also referred to as BU, the Banking Union is one of the main financial initiative from the European Union and it keeps evolving each year with new measures, in order to adapt this project to all of the new challenges that could come. It is applied to the 27 countries of the European Union and follows three main rules:

–Transparency (with the implementation of common rules and standards for all of the member countries)

–Unification (with the equal treatment of all the economic systems of the EU)

–Safety (with the intervention and prevention of financial problems that could happen in the monetary union)

The main objectives of the Banking Union are a stronger banking system for the EU and a better support to the Single Market Act.

To achieve these goals, the project is built on two main pillars:

-the Single Supervisory Mechanism (SSM)

-the Single Resolution Mechanism (SRM)

The SSM is a new system of banking supervision implemented by the European Union in order to ensure the safety of the EU banking systems, to increase the financial stability and to make sure that supervision is persistent and equal for all member countries. In the last few years, this tool got very promising and even exceeded the expectations.

The SRM is a more recent system that was implemented in the European law in order to ensure the efficient resolution of failing banks and to reduce the prices for the taxpayers.

The Single Market Act is a project introduced by the European Commission in 2011 and its purpose is to provide some measures to boost the European economy in the long term.

The Deposit Insurance Scheme (EDIS) is a project proposed by the European Commission in 2015 and which aims are to make the insurance covers safer inside the euro zone.

The Banking Union gathers all of these different tools and each of them play a significant role in the establishment of this initiative. The success of the Banking Union depends on the respect of all the measures.

The Covid-19 pandemic also raised new issues and new challenges in the economic field so new measures from the European Union could see the light in the next months or years.

In the future, the European Union will have to make progress on the Capital Markets Union, as a complement to the Banking Union, in order to provide help for the respect of the single market and support the major role of the euro.

References:

Cairn. 2017. A brief overview of the European Banking Union. [ONLINE] Available at: https://www.cairn.info/revue-l-europe-en-formation-2017-2-page-61.htm. [Accessed 21 June 2022].

European Central Bank. 2022. Banking union. [ONLINE] Available at: https://www.bankingsupervision.europa.eu/about/bankingunion/html/index.en.html#:~:text=The%20banking%20union%20is%20an,and%20safer%20market%20for%20banks.. [Accessed 21 June 2022]

European Commission – European Commission. 2022. What is the banking union | European Commission. [ONLINE] Available at: https://ec.europa.eu/info/business-economy-euro/banking-and-finance/banking-union/what-banking-union_en. [Accessed 21 June 2022].

Internal Market, Industry, Entrepreneurship and SMEs. 2022. Single Market Act. [ONLINE] Available at: https://ec.europa.eu/growth/single-market/single-market-act_en. [Accessed 22 June 2022].

KPMG. 2022. State of the Banking Union – KPMG Global. [ONLINE] Available at: https://home.kpmg/xx/en/home/insights/2017/12/state-of-the-banking-union-fs.html. [Accessed 21 June 2022].

Written by Cécile Mayeres

She holds a Master’s degree in Translation and Cross-Cultural Communication with a specialization in European mobility. She now does a traineeship in Communication at the Terminology Coordination Unit.